What We Do

- Home

- What We Do

Executive Bookkeeping & Financial Leadership

Welcome to The Financial Anchor’s, we define the scope of our Outsourced Finance Department, which combines day-to-day execution (bookkeeping) with high-level financial

governance (Controller/Comptroller).

Our value proposition is simple: Accuracy & Accountability, Driven by Executive Expertise. We explicitly solve the problem of growing businesses/nonprofits that need a high-level finance executive but cannot afford a full-time hire.

The Problem We Solve: Bridging the Financial Gap

Many growing organizations reach a point where basic bookkeeping is no longer enough to ensure stability, compliance, or growth. This creates two distinct pain points, depending on your sector:

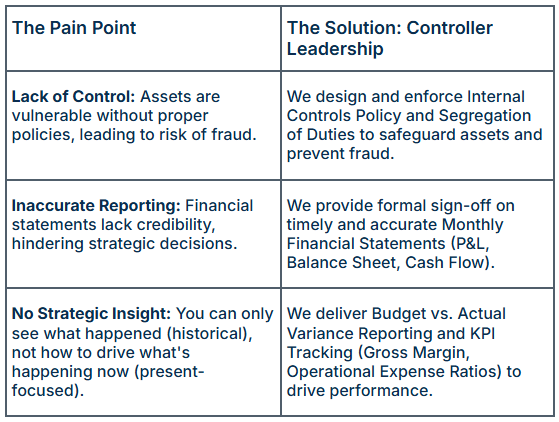

For Growing Small Businesses (The Controller Gap)

For Mission-Driven Nonprofits (The Comptroller Gap)

For Growing Small Businesses

(The Controller Gap)

The Pain Point

The Solution: Controller Leadership

Lack of Control: Assets are vulnerable without proper policies, leading to risk of fraud.

We design and enforce Internal Controls Policy and Segregation of Duties to safeguard assets and prevent fraud.

Inaccurate Reporting: Financial statements lack credibility, hindering strategic decisions.

We provide formal sign-off on timely and accurate Monthly Financial Statements (P&L, Balance Sheet, Cash Flow).

No Strategic Insight: You can only see what happened (historical), not how to drive what's happening now (present-focused).

We deliver Budget vs. Actual Variance Reporting and KPI Tracking (Gross Margin, Operational Expense Ratios) to drive performance.

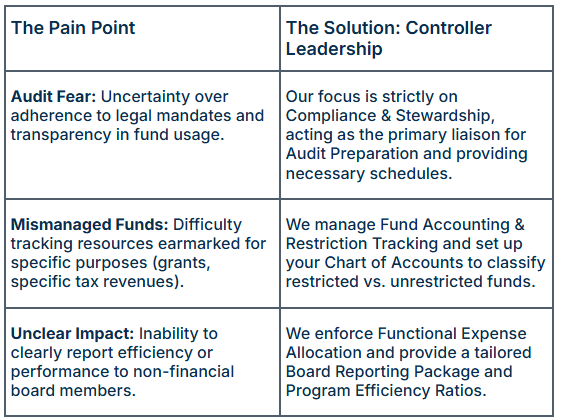

For Mission-Driven Nonprofits

(The Comptroller Gap)

The Pain Point

The Solution: Controller Leadership

Audit Fear: Uncertainty over adherence to legal mandates and transparency in fund usage.

Our focus is strictly on Compliance & Stewardship, acting as the primary liaison for Audit Preparation and providing necessary schedules.

Mismanaged Funds: Difficulty tracking resources earmarked for specific purposes (grants, specific tax revenues).

We manage Fund Accounting & Restriction Tracking and set up your Chart of Accounts to classify restricted vs. unrestricted funds.

Unclear Impact: Inability to clearly report efficiency or performance to non-financial board members.

We enforce Functional Expense Allocation and provide a tailored Board Reporting Package and Program Efficiency Ratios.

The Financial Anchor's Service Structure

We combine the core technical bookkeeping skills with the specialized mandate of either the Controller or the Comptroller.

1. Foundational Bookkeeping Core

This ensures we have a strong, accurate base for all executive functions:

- Accurate A/R, A/P, and payroll entries.

- Bank reconciliation.

- Data Integrity.

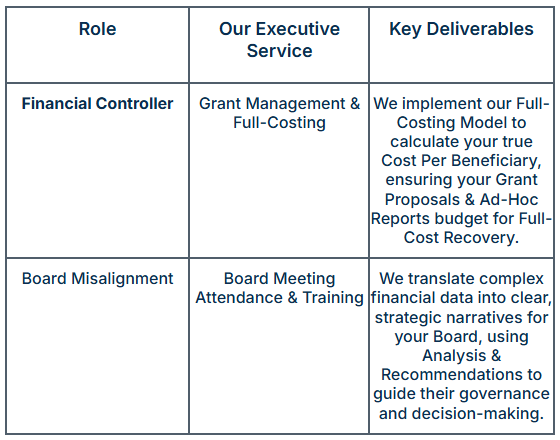

2. Specialized Executive Oversight

The crucial distinguishing element. This high-level service is performed by our Senior Strategist who acts as your Fractional Controller/Comptroller.

Role

Our Executive Service

Key Deliverables

Financial Controller

Grant Management & Full-Costing

We implement our Full-Costing Model to calculate your true Cost Per Beneficiary, ensuring your Grant Proposals & Ad-Hoc Reports budget for Full-Cost Recovery.

Board Misalignment

Board Meeting Attendance & Training

We translate complex financial data into clear, strategic narratives for your Board, using Analysis & Recommendations to guide their governance and decision-making.

3. Key Operational Requirements

To deliver executive-level oversight, our operations are highly disciplined:

- Standardized Controls Manual: We implement a policy template for every client, which is the hallmark of the Controller/Comptroller role.

- Technology Stack: We use Core Accounting tools (like QuickBooks Online Advanced) that support the needs of both sectors, including Fund Accounting. We also use advanced reporting tools (like Fathom or Jirav) to adhere to the different standards required (GAAP vs. FASB).

By utilizing our services, you gain the technical accounting required for stability and the financial governance needed for growth.

Ready to Anchor Your Finances?

Are you ready for the deep technical expertise and executive-level financial oversight tailored to your unique compliance needs

Contact The Financial Anchor for an Executive Strategy Session.