Market Areas

- Home

- Market Areas

Specialized Financial Governance for Unique Compliance Needs

At The Financial Anchor, we reject the one-size-fits-all approach to financial management. Our commitment to excellence is rooted in the strategic identification of specializations, ensuring our bookkeeping services are always deployed with the precise Controller or Comptroller leadership required to address your organization’s unique challenges.

We provide Accuracy & Accountability, Driven by Executive Expertise.

Market Area 1:

Growing Small Businesses

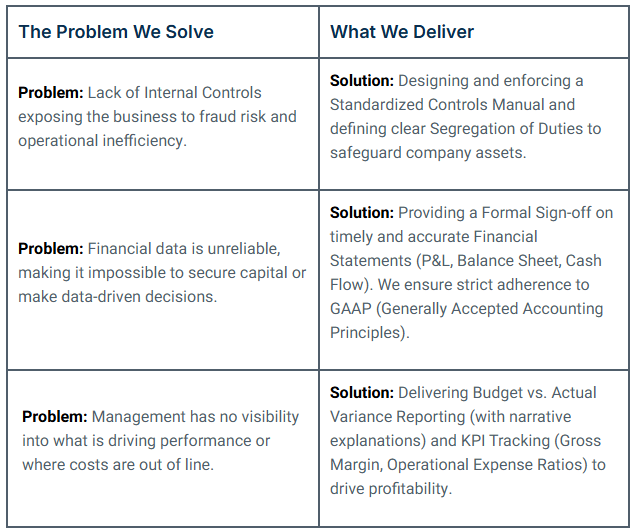

The Focus: Profitability, Efficiency, and Financial Control (The Controller Function)

Growing businesses frequently struggle with the transition from simple cash accounting to a complex system that supports scaling. They need Financial Controller expertise to implement robust processes, safeguard assets, and provide clear reporting necessary for strategic investment and expansion.

The Problem We Solve

What We Deliver

Problem: Lack of Internal Controls exposing the business to fraud risk and operational inefficiency.

Solution: Designing and enforcing a Standardized Controls Manual and defining clear Segregation of Duties to safeguard company assets.

Problem: Financial data is unreliable, making it impossible to secure capital or make data-driven decisions.

Solution: Providing a Formal Sign-off on timely and accurate Financial Statements (P&L, Balance Sheet, Cash Flow). We ensure strict adherence to GAAP (Generally Accepted Accounting Principles).

Problem: Management has no visibility into what is driving performance or where costs are out of line.

Solution: Delivering Budget vs. Actual Variance Reporting (with narrative explanations) and KPI Tracking (Gross Margin, Operational Expense Ratios) to drive profitability.

Market Area 2:

Mission-Driven Nonprofits

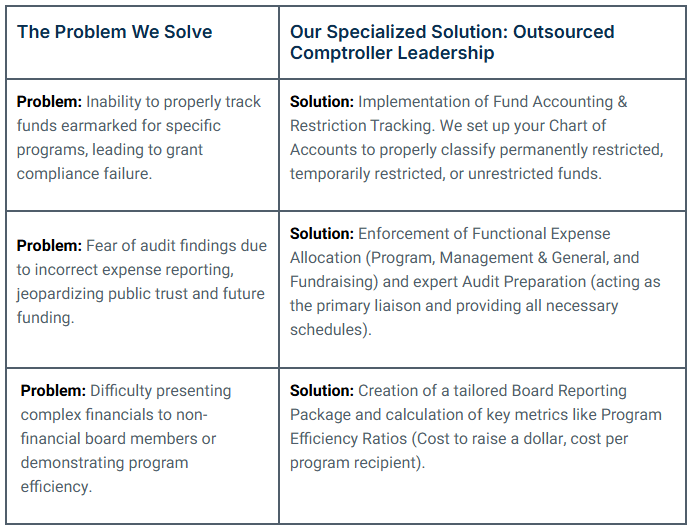

The Focus: Compliance, Stewardship, and Public Accountability (The Comptroller Function)

Nonprofits have a distinct challenge: their accounting must satisfy not only management but also boards, donors, and regulators. They require Comptroller expertise, focused strictly on compliance and ensuring the transparent stewardship of public and donated funds.

The Problem We Solve

Our Specialized Solution: Outsourced Comptroller Leadership

Problem: Inability to properly track funds earmarked for specific programs, leading to grant compliance failure.

Solution: Implementation of Fund Accounting & Restriction Tracking. We set up your Chart of Accounts to properly classify permanently restricted, temporarily restricted, or unrestricted funds.

Problem: Fear of audit findings due to incorrect expense reporting, jeopardizing public trust and future funding.

Solution: Enforcement of Functional Expense Allocation (Program, Management & General, and Fundraising) and expert Audit Preparation (acting as the primary liaison and providing all necessary schedules).

Problem: Difficulty presenting complex financials to non-financial board members or demonstrating program

efficiency.

Solution: Creation of a tailored Board Reporting

Package and calculation of key metrics like Program Efficiency Ratios (Cost to raise a dollar, cost per program recipient).

Our Dual-Focus Commitment

Whether you are a growing business seeking profitability or a nonprofit seeking public accountability, The Financial Anchor provides the Executive Bookkeeping required for operational stability and the Financial Governance needed for sustainable growth.

Ready to apply executive-level oversight to your unique organizational needs?

Contact us today to ensure your financial practices are aligned with excellence.